Luxury retail market overview and trends

The luxury retail industry has been significantly impacted by the pandemic, with the top 100 luxury goods companies seeing a 12% drop in revenue in 2020, totalling $252 billion. The pandemic also caused a sudden shift in consumer habits towards digital channels, which initially caused problems for brands and retailers but many were able to quickly adapt and see growth in sales return through these channels.

The rise of Gen Z and Gen Y or millennial shoppers in the luxury market, combined with the increasing use of mobile devices and social media as shopping tools, has played a significant role in boosting luxury sales in 2020. Social media, particularly popular among younger audiences, has become a crucial marketing channel for luxury retailers, as the number of global social media users increased by 21% during the pandemic. This shift towards digital channels has also led to an increase in online sales for luxury brands, which will likely continue to be important in the future as the industry adapts to a post-pandemic world.

However, brick-and-mortar boutiques still play a crucial role in the luxury experience, offering social discovery, the allure of exclusivity, building trust, and personalisation. Luxury brands are blending online and in-store channels to create a unified experience for customers and experimenting with new ways such as virtual try-ons, mobile apps, and NFT accessories. To maintain the traditional luxury experience, it is important for luxury brands to deliver personalised experiences across all customer touchpoints, which can be achieved by using a Customer Data Platform.

What is a Customer Data Platform?

CDPs are the type of software that aggregate customer data collected from a variety of sources, structure it into central customer profiles, and then share data with other marketing technology systems.

CDPs build these customer profiles by combining data from a variety of stores across different data types, including first, second and third-party sources. That means that they can collect and organise data from the Company’s CRM, DMP, data lakes or warehouses, websites or mobile apps, and/or POS systems. With these profiles created, marketers can then create audience segments, and activate them across other channels such as paid media, SMS marketing, customer service tools and even website personalisation.

The end result is the ability to not only manage data in a compliant and structured way, but also to be able to efficiently deliver targeted, personalised experiences at scale across the whole of the customer journey, bringing commercial outcomes in no time.

How will CDPs drive growth for luxury retail brands?

The luxury market’s ability to adapt to evolving customer tastes is essential to maintain market share and identify growth opportunities. In the luxury retail sector, digital trends are evolving at an unprecedented pace, driven by the preferences of Millennial and Generation Z customers. As a result, luxury brands must tailor the customer experience to align with individual tastes and styles. To achieve this, luxury brands must use customer data to create personalised strategies that increase loyalty and sales.

Customer Data Platforms (CDP) are a crucial tool for luxury brands to analyse and activate data to improve and personalise the customer experience, to stay ahead of evolving customer expectations and competition. CDPs offer a broad range of benefits, including:

- Delivering unified views of customers and their interactions across every touchpoint

- Maintaining strict compliance and privacy standards in the handling of customer data

- Creating the ability to activate customer data to deliver personalised experiences across every marketing and service channel.

Getting in more specific details, CDPs for luxury brands are crucial for:

- Create a 360-degree view of the customer stitching online/offline data to be able to leverage personalisation to delight customers

The luxury retail industry has seen significant growth in e-commerce, but the increase in first-party data assets is not as fast or as significant as in other sectors such as fast moving consumer goods (FMCG).Purchase volumes and frequencies are not as high in the luxury retail space, and customers are not driven by value or price. Therefore, luxury brands cannot rely on monetary incentives to increase newsletter subscriptions or website and app memberships. With limited actionable customer data, luxury retailers must focus on improving the scalability and addressability of their existing data by using Customer Data Platforms (CDPs) to create a 360-degree view of the customer. CDPs can help break down legacy data silos and bring together various data points, such as online behaviour, loyalty program and membership data, and offline data from CRM and POS systems.

In some cases, luxury retailers may be able to benefit from cross-group data sharing. For example, a luxury group could use demographic data from one maison and purchase history from another to create an advanced single view of a customer, and then use that data to retarget the customer on special occasions.

Create a better segmentation of the target audience to be able to offer unique customers’ special moments on each preferred media platformsAnother benefit of using Customer Data Platforms for luxury groups is to create different audience segments based on different customer signals across the marketing funnel. Behavioural data collected through web and app data sources can be used to tailor messages and personalise branding campaigns. Using CRM data can help identify high spenders, loyalists, collectors, and dormant past brand enthusiasts. This information can be used to create segments based on purchase recency, frequency, and lifetime expenditure, and activate them across preferred marketing and advertising channels.When it comes to activating these segments, CDPs can make the process seamless by providing native channel integrations such as TikTok, Snapchat, Facebook, and YouTube. They should also have the capability to achieve substantial match rates when pushing out first-party data, and have features that handle consent orchestration and privacy in accordance with GDPR regulations, allowing customers to choose how, where and which data is being used.

- Create time to value commercial outcome, leveraging on customers’ data and optimising the media budget

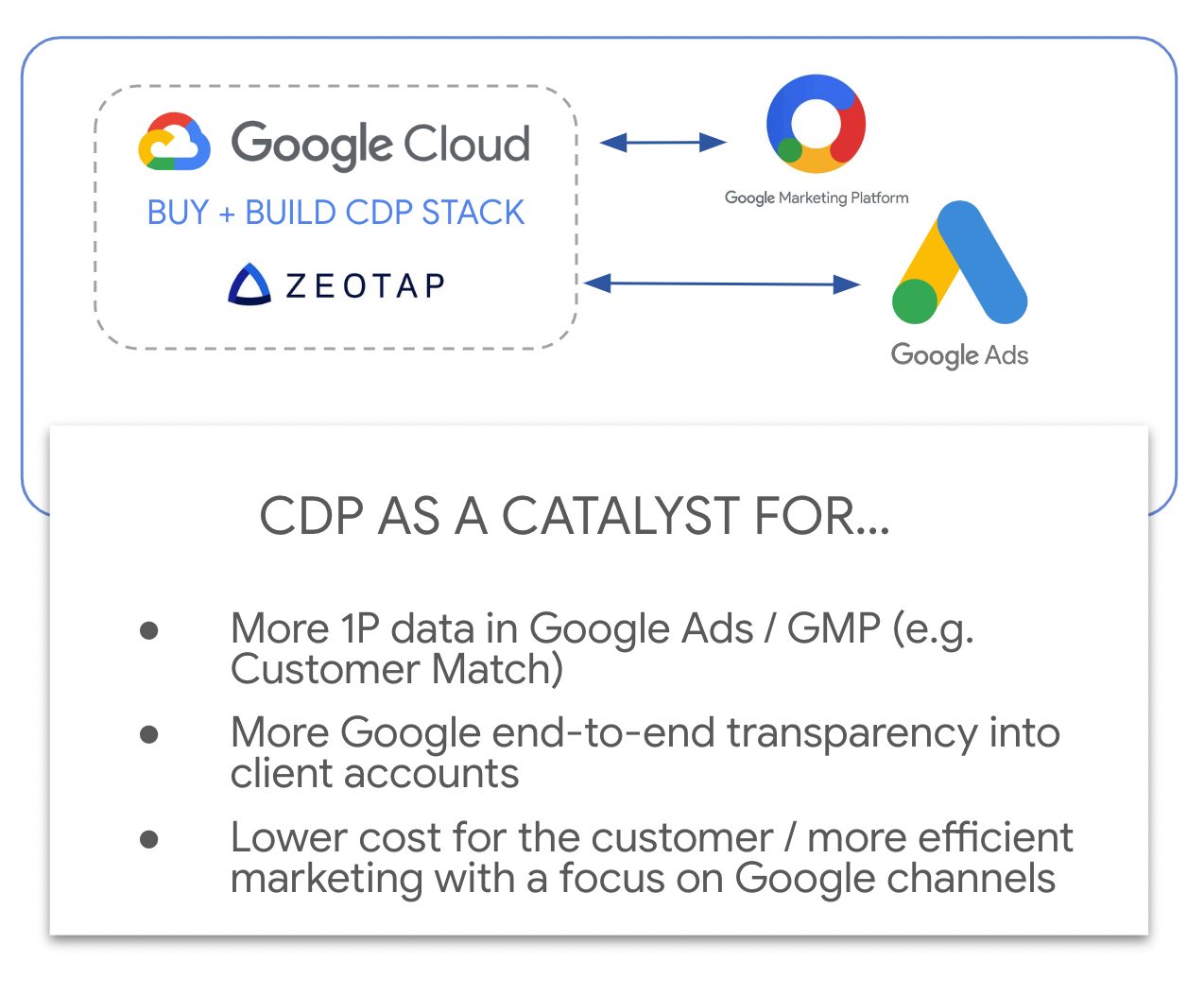

Many luxury retailers, like other e-commerce and retail advertisers, allocate a significant portion of their paid media budget to the Google advertising ecosystem. To optimise the ad spend, it can be beneficial to finda Customer Data Platform (CDP) that has a partnership with Google. These CDPs use partner APIs to populate matched segments directly in brands’ Google advertising accounts. This allows for faster data onboarding using a user-friendly interface and native connector, without the need for building an in-house Google Ads API or managing login credentials. Additionally, these CDPs can use additional first-party customer information, such as email addresses, phone numbers, and alternate emails, to increase the segment size. An example of such CDP is Zeotap, which uses proprietary identity stitching and extension capabilities to find emails corresponding to customers’ phone numbers and email addresses, and append these emails to the existing email list prior to uploading.

Why Zeotap CDP

Additionally, Zeotap provides powerful identity stitching strategies, so marketers can build segments without coding or technical skills required on GCP (Google Cloud Platform) which offers the advantages of low latency and cost efficiency, all wrapped up by their commitment to privacy above all else!Zeotap CDP can be the best solution to boost luxury retail growths thank to:

- Immediate value within a 4+4 framework to realise commercial outcomes in 8 weeks

- Easy deployment with turnkey integrations to make existing tools better

- Natively built on Google Cloud Platform

- Intuitive interface that is built for marketers to achieve quick results with minimal effort

- Best-in-class ID stitching

- Privacy compliance, developed for stringent European regulation, adaptive to other data protection protocols.

Purchase volumes and frequencies are not as high in the luxury retail space, and customers are not driven by value or price. Therefore, luxury brands cannot rely on monetary incentives to increase newsletter subscriptions or website and app memberships. With limited actionable customer data, luxury retailers must focus on improving the scalability and addressability of their existing data by using Customer Data Platforms (CDPs) to create a 360-degree view of the customer. CDPs can help break down legacy data silos and bring together various data points, such as online behaviour, loyalty program and membership data, and offline data from CRM and POS systems.

Purchase volumes and frequencies are not as high in the luxury retail space, and customers are not driven by value or price. Therefore, luxury brands cannot rely on monetary incentives to increase newsletter subscriptions or website and app memberships. With limited actionable customer data, luxury retailers must focus on improving the scalability and addressability of their existing data by using Customer Data Platforms (CDPs) to create a 360-degree view of the customer. CDPs can help break down legacy data silos and bring together various data points, such as online behaviour, loyalty program and membership data, and offline data from CRM and POS systems. Create a better segmentation of the target audience to be able to offer unique customers’ special moments on each preferred media platforms

Create a better segmentation of the target audience to be able to offer unique customers’ special moments on each preferred media platforms Many luxury retailers, like other e-commerce and retail advertisers, allocate a significant portion of their paid media budget to the Google advertising ecosystem. To optimise the ad spend, it can be beneficial to finda Customer Data Platform (CDP) that has a partnership with Google. These CDPs use partner APIs to populate matched segments directly in brands’

Many luxury retailers, like other e-commerce and retail advertisers, allocate a significant portion of their paid media budget to the Google advertising ecosystem. To optimise the ad spend, it can be beneficial to finda Customer Data Platform (CDP) that has a partnership with Google. These CDPs use partner APIs to populate matched segments directly in brands’